CMAN Delivers Strong Q1/2025 Performance in a Challenging Business Environment

Strong liquidity, declining finance costs, and continued confidence in the Company’s regional business model

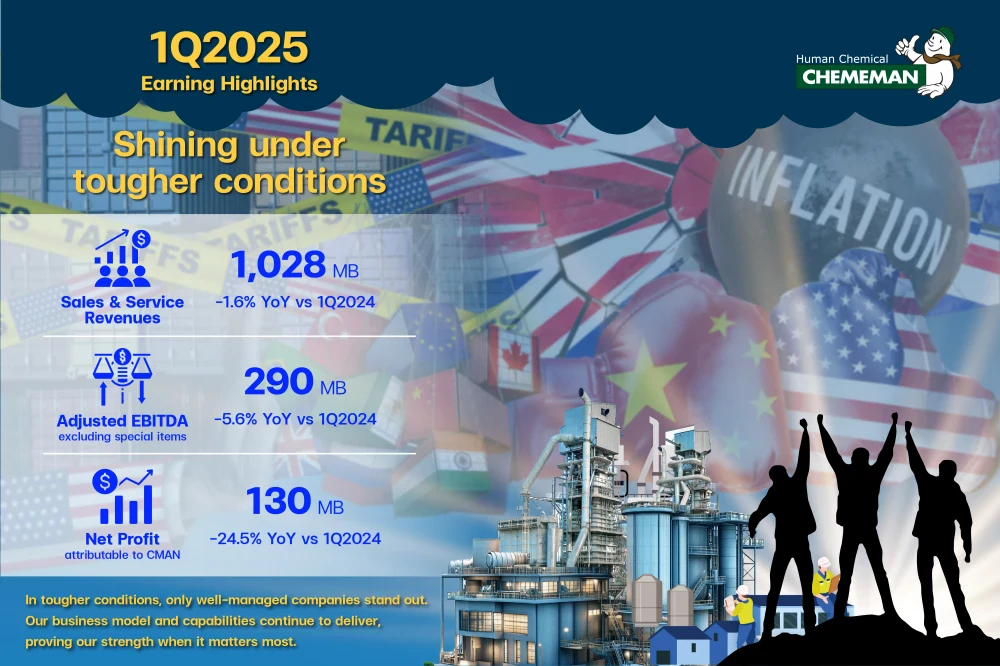

M.L. Chandchutha Chandratat, Chairman of the Board of Chememan PCL. (SET: CMAN), a leading global lime producer under the 'CHEMEMAN’ brand, reported that the Company achieved first quarter sales and service revenues of THB 1,028 million, down 1.6% YoY. Adjusted EBITDA (excluding special items) was THB 290 million, down 5.6% YoY, and net profits attributable to shareholders were THB 130 million, representing a 24.5% YoY decrease. Excluding non-cash and special items, net profits attributable to shareholders would have been THB 132 million, a 10.2% YoY decline.

Domestic revenues increased through higher demand from sugar manufacturers, while international revenues dropped as a result of: 1) more aggressive competition in the lime market; 2) lower demand from the mining sector; and 3) the impact of a stronger Thai Baht. However, limestone sales recorded significant growth, contributing positively to CMAN’s overall performance. Overall, revenues remained strong, although the cost of goods sold rose slightly, primarily due to higher maintenance costs. As a result, the gross profit margin declined to 36.6%, compared to 38.4% in Q1/2024. Nevertheless, operating cash flows remained solid at THB 271 million, and the Company’s debt-to-equity ratio improved to 1.3x, reflecting healthy liquidity and lower finance costs.

M.L. Chandchutha further highlighted that despite challenging market conditions, including FX volatility and lower demand from certain sectors, rising freight costs, and high geopolitical tensions, CMAN continues to achieve its performance targets. The numbers reflect successful execution of its regional business model, with effective risk management, disciplined cost controls, and ability to make fast and flexible decisions.

In 2025, CMAN is prioritizing sales growth at appropriate price levels. At the same time, energy and logistics costs are expected to decline gradually over the year.

CMAN is also working closely with its Vietnam subsidiary to secure local bank financing, which, if successful, will further reduce FX-related impacts on the income statement.

In an increasingly difficult operating environment, only companies with strong fundamentals can achieve their desired performances. With over two decades of business experiences, CMAN’s strong fundamentals are showing during this time of uncertainty.